The Market

Market and market position of the Issuer

The Issuer provides innovative solutions in the field of education drivers vehicles of all categories. This is a large and highly competitive market. The total number of driving schools in Russia the end of 2017 is estimated at 6.8 thousand: private schools, division of DOSAAF, driving school all-Russian society avtomobilistov (VOA).

In Saint-Petersburg listed 229 educational institutions, carry out driver training.

Despite the fact that the Issuer is one of the leading high-tech driving schools in Russia, its share is small at about 1%. Market driving schools are not consolidated and has the potential to build large the Russian player, which means become the Issuer.

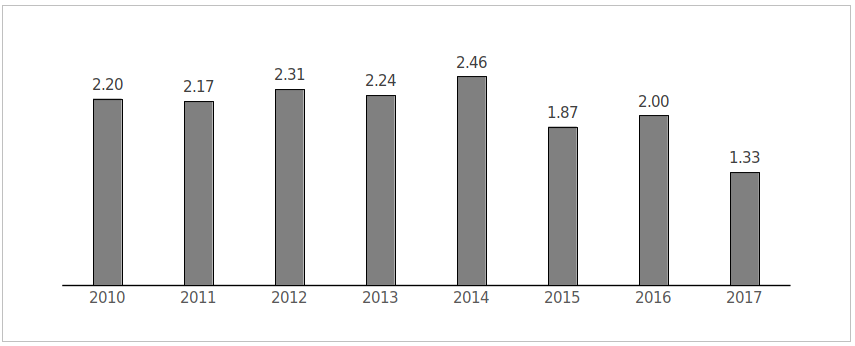

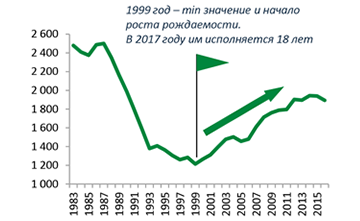

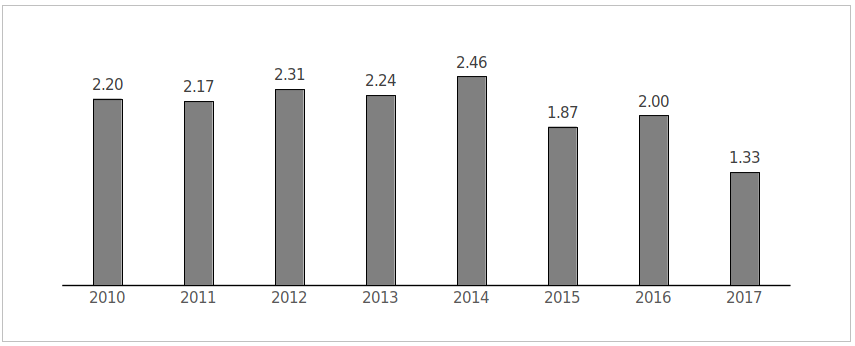

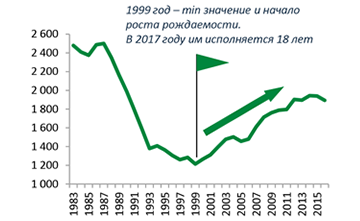

It is important to note, despite almost twice the fall the number of students from 2.46 million in 2014 to 1.33 million in 2017, The Issuer was able to increase its performance: during the same period, the number of students increased from 7 to 12 thousand people. Drop market demand for training services driving was associated with demographic the hole by the end of 1990-ies. In 2018 marked the growth of the market, which will continue in connection with the increasing demand by young people, born in 2000-ies.

For 2017 the driver's license 1.33 million man, ~85% of them - for the first time. On the basis of this annual coverage of the Issuer it is possible to estimate approximately in 0,7-0,8% in natural expression.

On the category "In" in 2017 accounted for 80% of the issued identity (1.07 million units). As in 2018 the cost of training in driving schools varies from approximately 15 000 (small city) to about 65 000 (Vorkuta) rubles, on average, officials announced 25 000 — 30 000 rubles.

If you take the average training cost 30 thousand RUB, the total annual revenue driving schools in 2017 is estimated at 33,9 billion (only cat.In). Then share the company's market for 2017 will be approximately 0.7% in money terms.

The issuance of driver's licenses in Russia

Source: GIBDD Russian Federation

The ideal time for the emergence of a strong and modern leader with $1+billion market, is able to give a better alternative to the huge number of noname traditional schools and to meet the growing demand of the corporate sector

Key features of the market

Annual Russian demand for driver training is 2-2,5 million.

On average, the market, schools represent the 1-2 classroom

The average cost of a training course in the market is 25-30 thousand ₽ / student

Reforms have on the driving school a lot of pressure in the form of new requirements for training in driving schools.

The market is strongly diversified, in the public plane is not aware of any major private player

Market students

(end users)

The market of driving schools.

(B2B2C)

Market for learners

(end users)

60 bln.

R/year

(2,5 mln. people/year)

6 bln.

R/year

(7 thousand school)

1 bln.

R/year

(0,45 mln. people/year)

Итого ≈70+ млрд. Р в год

13 bln.

R/year

(0,5 млн. people/year)

1,7 bln.

R/year

(1 thousand schools)

0,3 bln.

R/year

(40 thousand people/year)

Key drivers of market growth

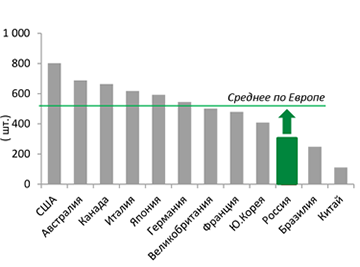

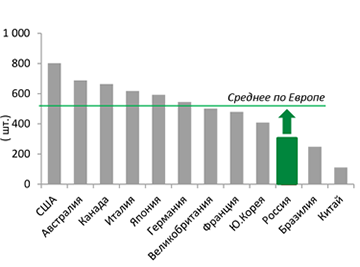

In Russia, the extremely low number of cars per 1000 persons of the population.

>2 growth potential of the indicators and 50% increase of the adult population will stimulate the growth of the market fundamentals in the medium term

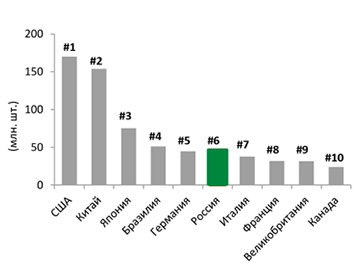

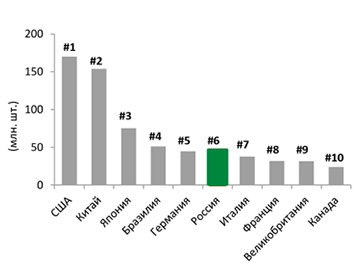

Russia is the #6 country in the world and #2 in Europe by fleet size ...

... this leaves a huge potential growth market

50% potential growth in the number of students due to the increase of the population over the age of 18 (tolerance to driving)

World TOP 10 countries by number of cars on the road

Park of cars per 1000 inhabitants in the country

Dynamics of birth rate

Competition online

The market of remote training of drivers in its infancy, is not aware of any big private player. As the main competitors have been selected companies that provide the theoretical part of the training remotely-based platforms for learning.

| Companies:

|

|

|

|

|

| description of the company:

|

|

Online driving school, provides access to theoretical and practical training at the driving school partners. Sells contracts to partners

|

Online driving school, provides access to the theoretical part and practical training at the driving school partners

|

Online driving school, provides access to the theoretical part and practical training at the driving school partners

|

| Positioning

|

B2C + B2B (in-house training + access to the platform partners)

|

B2B (only through partners)

|

B2B (only through partners)

|

B2B (only through partners)

|

| The company's revenue in 2016:

|

220 mln R

|

≈12,7*mln R

|

≈9,9*mln R

|

≈9,7*mln R

|

| Accessibility platform (www & mobile):

|

www & mobile (In development)

|

www

|

www

|

www

|

| Adaptability of the platform:

|

High

|

Average

|

Low

|

Low

|

| Content platform:

|

Full

|

Limited

|

Limited

|

Insufficient

|

| Geography

|

Saint-Petersburg, the Leningrad region, Moscow, Moscow region, Nizhny Novgorod, Kursk, Chelyabinsk

|

Moscow

|

30 cities in Russia

|

Moscow

|

Success stories in the world

Relevance and potential of niche market the driving education confirmed successful regional stories as in a traditional offline business and online direction

Trend offset driver training from offline to online

History 1. Traditional offline training.

History of organic and M&A growth

- Revenue: $200 million (2015)

- Capitalization: $2 billion

- Number of students: 150 thousand/year

Founded in 2005

- 2011-2015. The company has grown an average of 40% per year (with revenue of $70+million to $200 million.)

- In January 2016 IPO (the company raised $120 million)

- After raising funds, the Company started active expansion through M&A transactions:

Network of driving schools in Jiangxi (Jun. 2016, $45mln.)

Network of driving schools in the area Yunnan (APR. 2016)

Network of driving schools in some parts of China (Dec.2016, $27mn.)

- To date, the largest in the world

Story 2. Online + traditional training.

The history of M&A and expansion into other services

- Revenue: not disclosed

- Capitalization: not disclosed

- Number of customers: 10 million (for all time)

Founded in 2005

- Founded as an online alternative to traditional courses, driving

- Active the company's growth can be linked with the receipt of investment by CIP Capital in 2012

- In 2015, a merger of I Drive Safely and DriversEd.com. A new company called brands eDriving – the us market leader in online driving instruction

"Horizontal" growth through the acquisition of two companies in related segments (system of safety management of the vehicle fleet and telematics measurement):

- –Mentor eData – telematic dimension (March 2016)

–Interactive Driving Systems - safety management system the car Park (March 2016)

Story 3. Online resource.

History of organic growth

- Revenue: not disclosed

- Capitalization: not disclosed

- Number of students: 50 thousand/year

Founded in 2005

- Founded in 2013

- Implement the concept of a marketplace of learning to drive with providing access to educational content

- Classic venture history of the development by raising rounds of funding:

- 3 round raised $7.3 million

- At the moment, is the largest education company in the UK:

-10% of students who use the platform

-3000+ qualified and validated instructors

-50+ thousand students annually